pay ohio property taxes online

So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year. Online Greene County property owners can pay their tax bills online using NIC online payment services.

Property Tax How To Calculate Local Considerations

Thus if your county assessor appraises your property at 100000 your assessed value will be 25000.

. Any payments made after 800 PM. Taxes are not applied to that full market value rather to the assessed value. The convenience fee is paid to NIC Services.

Therefore looking at specific counties will give you a better sense of how high property taxes can actually get. Homeowners have to pay these fees usually on a monthly basis in combination with their mortgage payments. Across the United States the mean effective property tax ratetotal real.

Must have parcel or registration number. The Highest Property Taxes by County. Tennessee Property Tax Rates.

Phone payments are available for real estate and manufactured home taxes by dialing 866 648-1955 via Point and Pays Intelligent Voice Recognition. Your tax rate applies to that amount. ATTOM Data Solutions reports that the counties with the highest effective tax rate as of 2020.

For individuals and businesses. Taxpayers should pay their income tax due by April 18 2022 to avoid late interest and penalties. For non-emergencies call.

For creditdebit card or eCheck payment by phone call 1-866-288-9803. Wednesday July 6th 2022 at 1123pm More info for those impacted by the confirmed radar-indicated tornado. Eastern time on the due date.

No Credit Card payments will be accepted by mail. Where to find property taxes plus how to estimate property taxes. Ad Pay Your Taxes Bill Online with doxo.

Eastern time will be processed on the next days date. There will be a convenience fee for this service that you will see before you submit your payment. For residential property assessed value is equal to 25 of market value.

Illinois homeowners still pay the sixth-highest median property tax bill in the. Check out our latest property taxes by state report and find out which states have the highest or the lowest property taxes in the US. While it can help to consider state averages property taxes are typically set at the county level.

Make a debitcredit or eCheck payment online. Property taxes or real estate taxes are paid by a real estate owner to county or local tax authoritiesThe amount is based on the assessed value of your home and vary depending on your states property tax rateMost US. Penalties and interest will be incurred after 800 PM.

New Income Tax Rate In accordance with Toledo Municipal Code 1905011 effective January 1 2021 the city of Toledo income tax rate will increase to two and one-half percent 25. Nonprofits are also exempt from paying sales tax and property tax. Apply online for a payment plan including installment agreement to pay off your balance over time.

While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes. Avoid a penalty by filing and paying your tax by the due date even if you cant pay what you owe. We are unable to accept credit card debit card or e.

Depending on where you live you may pay a modest amount in property taxes or your tax bill could rival your mortgage.

How To Pay The Treasurer S Office Of Clermont County Ohio

Infographic What Is A Short Sale Mortgage Tips Real Estate Infographic Things To Sell

Pin On Staten Island Real Estate Articles

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Real Estate Reality Tv Show Myths Real Estate Infographic Real Estate Investing Real Estate Advice

Property Taxes How Much Are They In Different States Across The Us

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

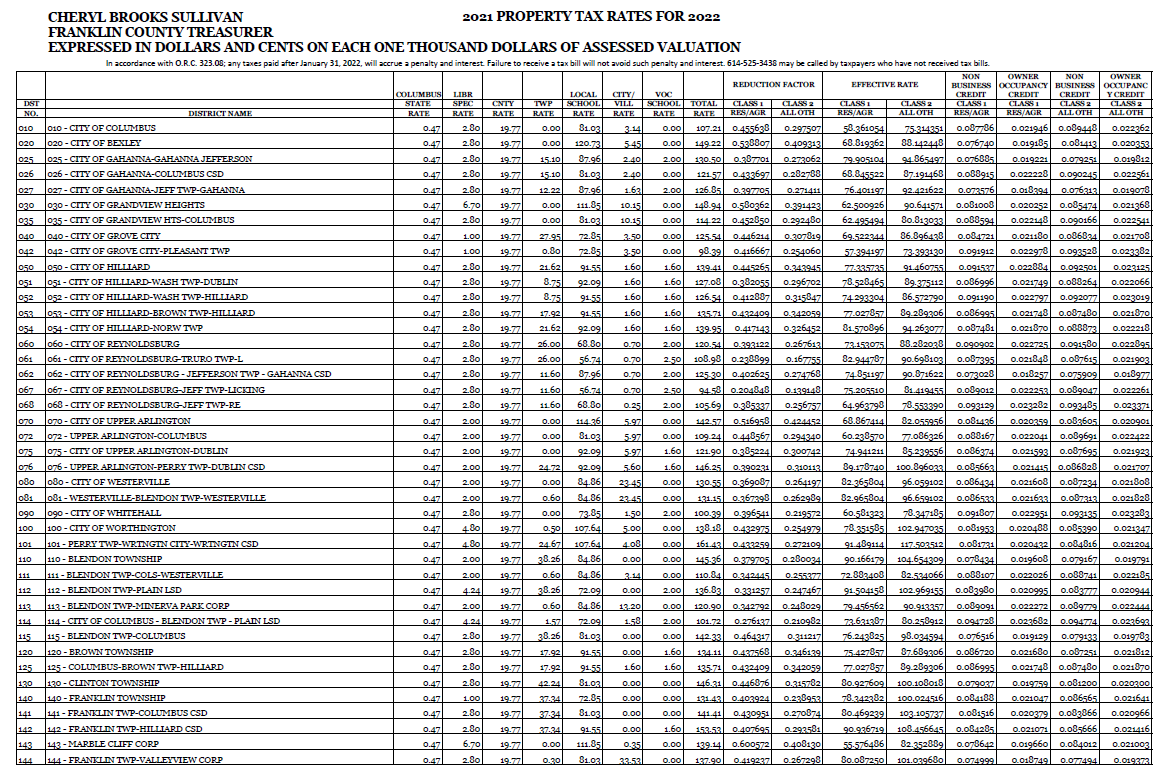

Franklin County Treasurer Tax Rates

Free Mortgage Calculator Calculate Monthly Payment Along With Taxes Insurance Mon Free Mortgage Calculator Mortgage Amortization Mortgage Payment Calculator

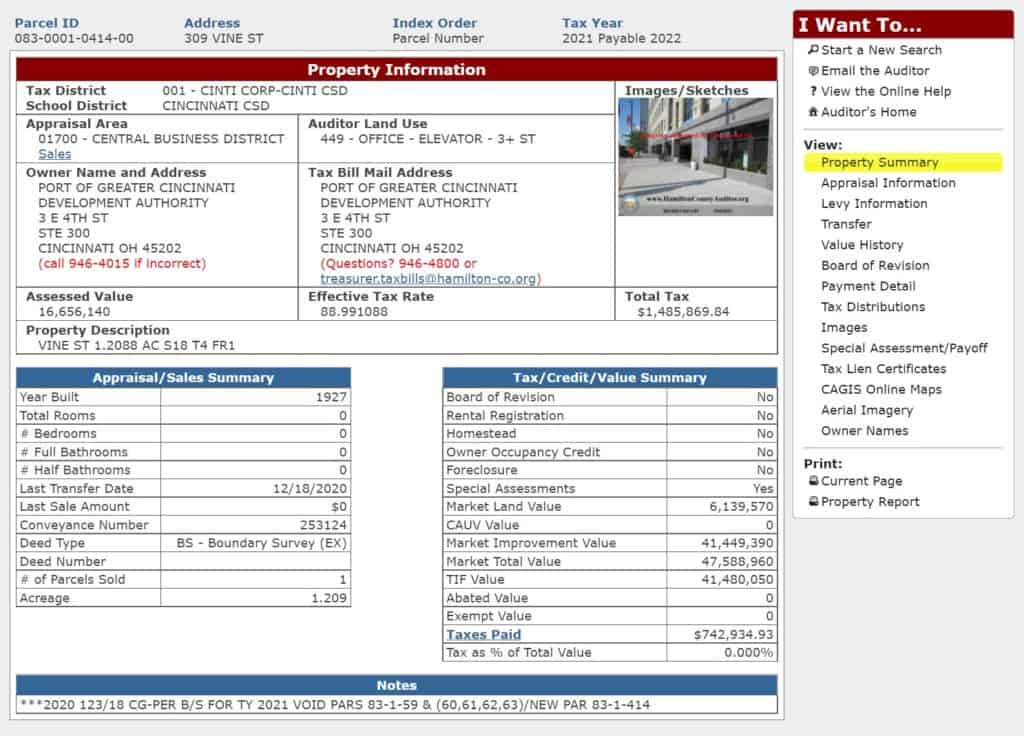

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

2022 Property Taxes By State Report Propertyshark

Cuyahoga County Extends Deadline For Property Tax Bill Payment

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Tax Information City Of Fairview Park Ohio

Real Estate Blog Mortgage Payment Property Tax Florida Real Estate

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Pin By Jill Miller On All Things Real Estate Home Buying Tips Real Estate Buyers Home Buying Process

Former Bar With Rental Space Online Auction 2853 Lagrange Street Toledo Ohio 43608 Bidding Ends Tuesday June Commercial Property Public Restroom Ohio